Accrued Directors Fees Tax Deductible Malaysia

Mtd computation for bonus and director s remuneration.

Accrued directors fees tax deductible malaysia. Director fee or any remuneration received by a statutory director from a company resident in malaysia with respect to their directorship is liable to malaysian tax. Only income that is accrued or derived from sources in malaysia is liable to tax. A public ruling is published as a guide for the public and officers of the inland revenue board of malaysia. If he is not subject to malaysian tax no mtd deduction should be made by the employer.

The title to the ownership. Epf socso payout on director is tax deductible as company expense. Therefore the amount applicable per month is rm3 000 00 rm36 000 00 12. Accruing directors fees is a tax deferral strategy as the company receives a tax deduction in one financial year but the related party directors are not taxed on the income till the following financial year.

Director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is empowered to make a p ublic r uling in relation to the application of any provisions of ita. B statutory audit fees expenditure p u a 129 income tax deduction for audit expenditure rules 2006 5 4 defending title to property legal expenses incurred in connection with defending a person s title to the ownership of an asset that is used in the business. Yes where director fees is received. Year 2009 onward with reference to new act para 25 2a of income tax act 1967 director s fee or bonus is receivable in respect of the whole or parts of the relevant period the fee or bonus when receive in relevant period shall be treated as gross income in the year of receipt.

Director s remuneration and tax planning evidence from malaysia. Director s remuneration and tax planning evidence from malaysia. So it gives flexibility in term of amount when there is a profit or based on company profit level. Direct taxation in malaysia is based on the unitary system and the basis of taxation is territorial in nature.

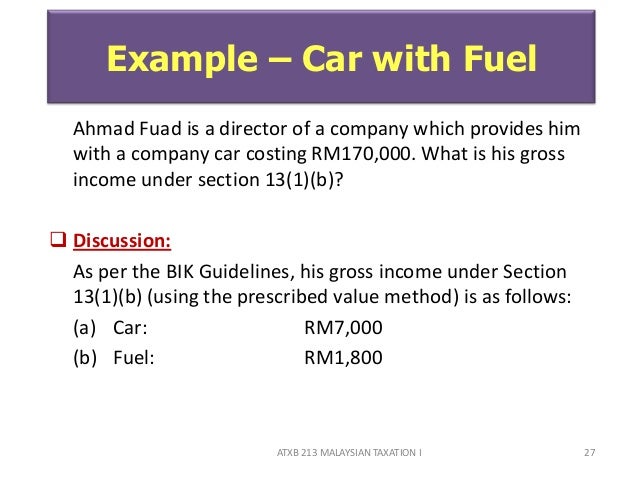

The std for rm3 000 is determined and then multiplied by 12. A will the taxation be triggered irrespective of whether or not the board member is physically present at the board meetings in malaysia. Income from foreign sources is liable to tax to the extent that it has its source of derivation in malaysia by a resident company. Difference between director drawing salary vs director fee director fee once in a year so you only declare when there is profit.

A director receives annual director s fee of rm36 000 00 without any other remuneration.

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)