California Income Tax Rate 2019 Single

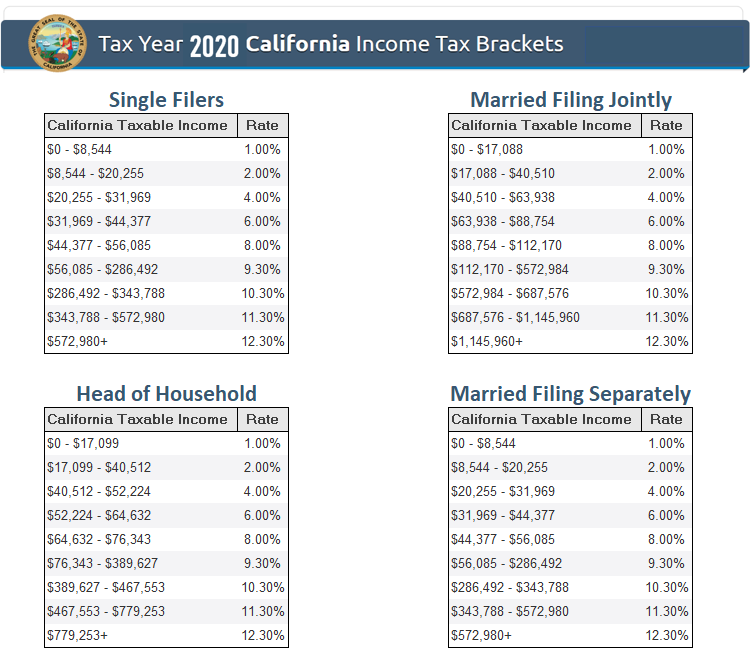

The california single filing status tax brackets are shown in the table below.

California income tax rate 2019 single. Required field california taxable income enter line 19 of 2019 form 540 or form 540nr caution. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 2 1 or a subsequent version june 22 2019 published by the web accessibility. These income tax brackets and rates apply to california taxable income earned january 1 2019 through december 31 2019. This calculator does not figure tax for form 540 2ez.

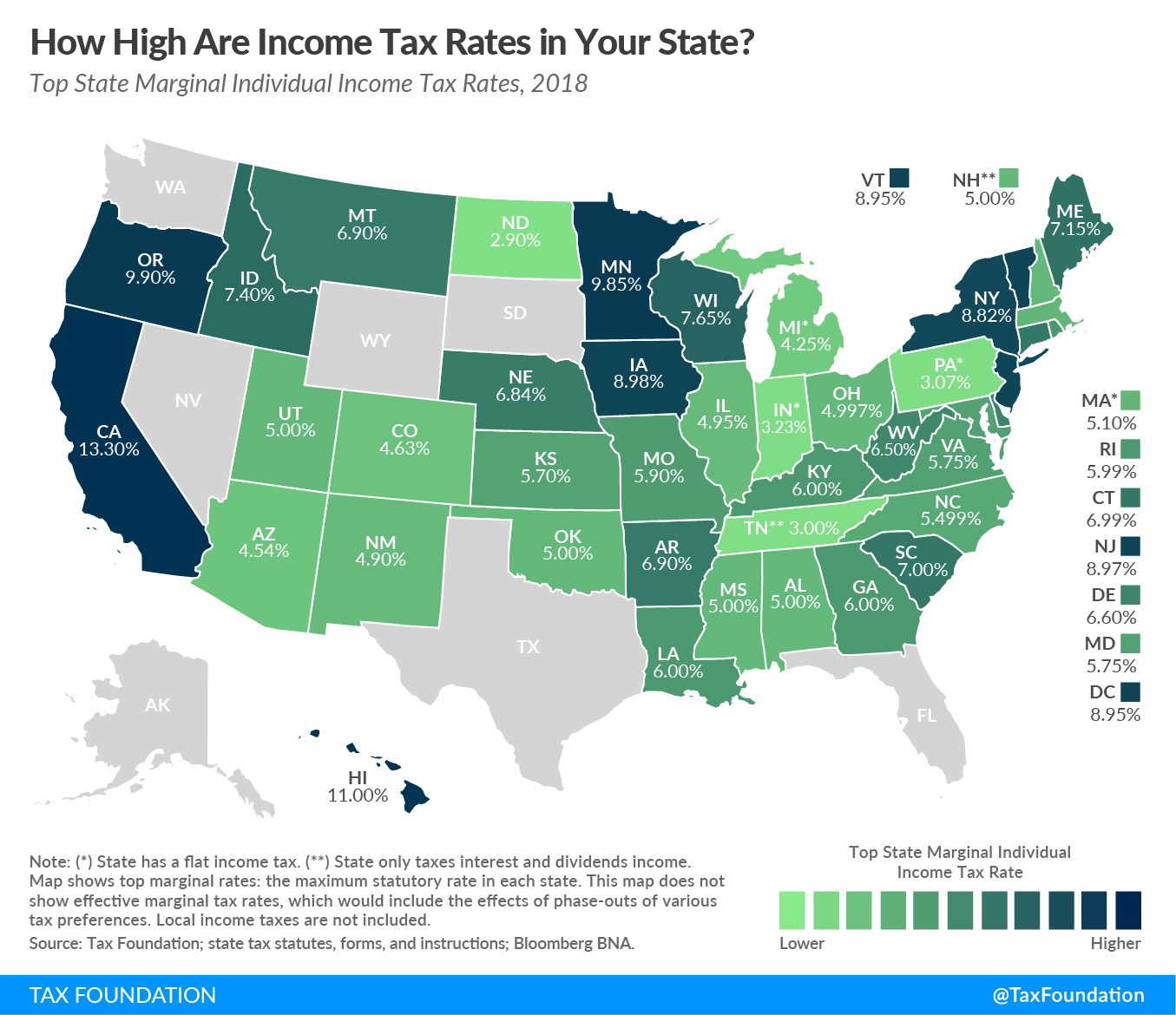

Adding the 1 millionaire s tax yields a top income tax rate of 13 3 which does not appear on the official tax rate schedules printed by the state. Do not include dollar signs commas decimal points or negative amount such as 5000.

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-finalv2-8a746a2ad14c4fba8d21382f812c7c76.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/457995115-F-56a938563df78cf772a4e248.jpg)