Certificate Of Tax Residence Malaysia

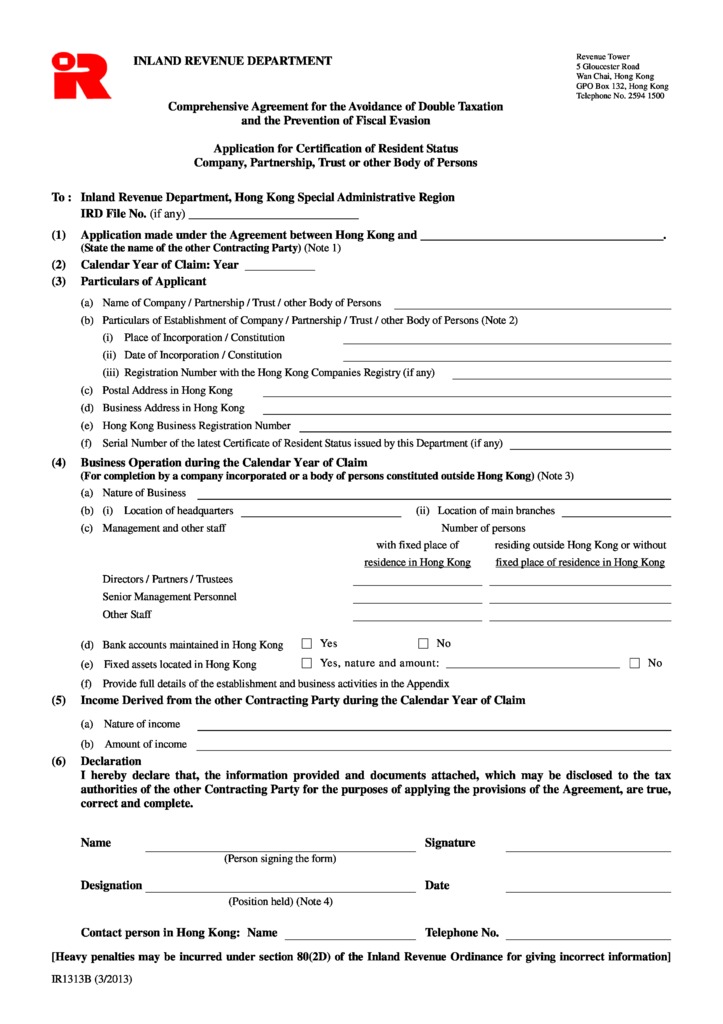

The cor is applied for in person with tax authorities and the employee must present their passport and documentation of travel in and out of malaysia for the past year.

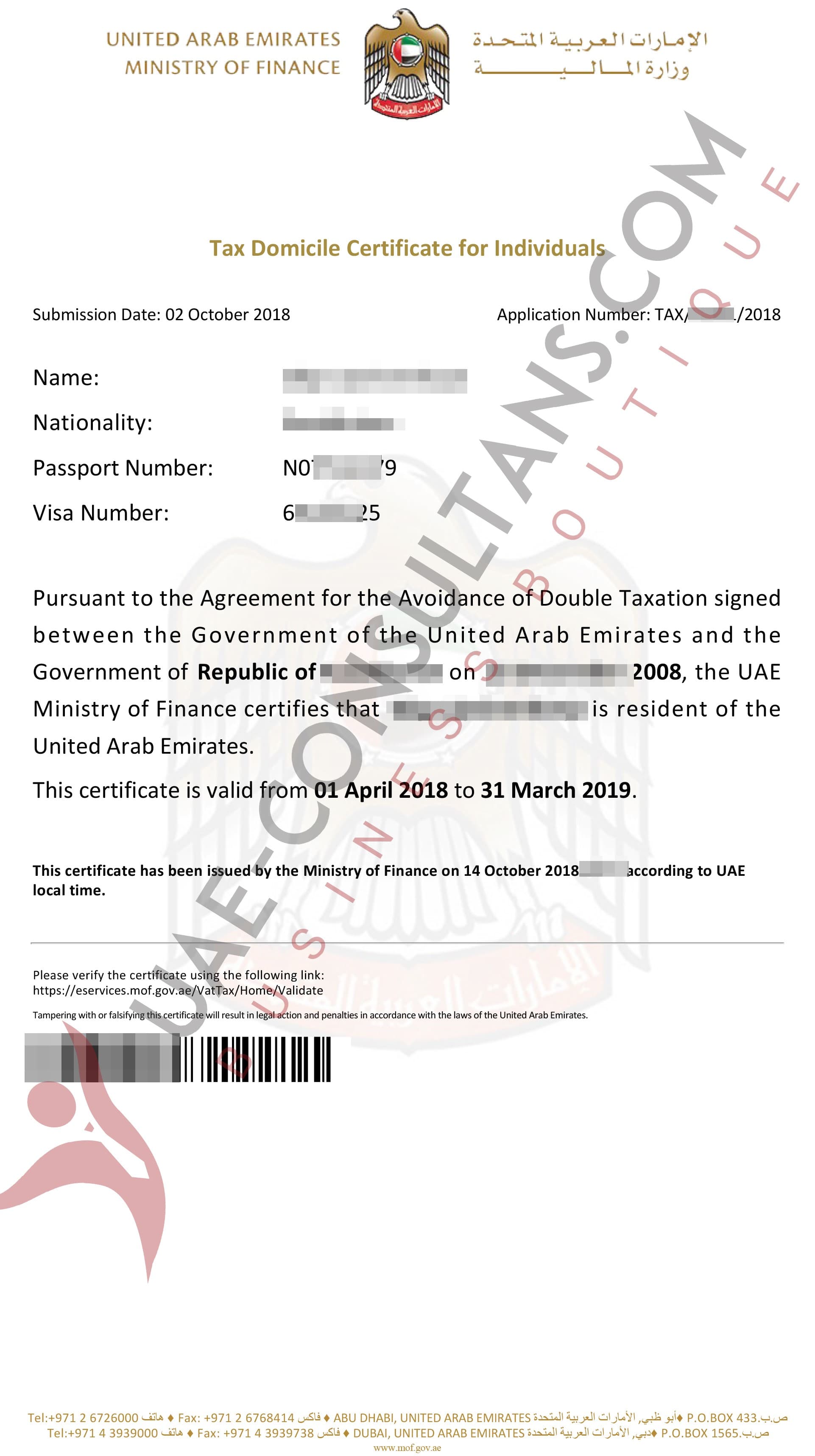

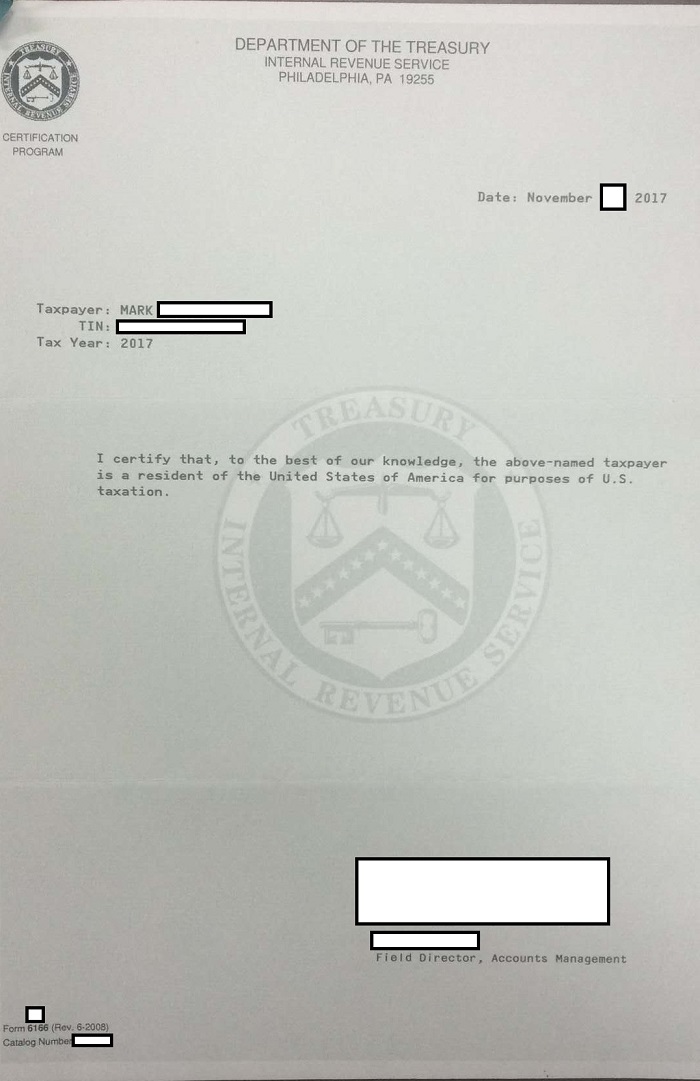

Certificate of tax residence malaysia. The certificate of residence cor is issued to confirm the residence status of the taxpayer enabling them to claim tax benefit under the dta and to avoid double taxation on the same income. Our processing fee for application of cor is from rm600 per application. You are considered a resident for tax purposes if. Bagi permohonan melebihi daripada satu stm borang stm1a perlu dilampirkan bersama borang stm1 form stm1a must be attached together with the stm1 form for application of more than one 3.

Hence a cor is issued for these purposes and with malaysia s treaty partners only. Dokumen sokongan tambahan yang diperlukan additional supporting documents required. A cor is issued to confirm the residence status of the taxpayer for the purpose of taxation. If you are running digital advertising campaigns in malaysia specifically on google facebook or linkedin you might want to pay attention to the withholding tax wht.

Must be fully completed for all certificate of residence cor application. 1 the individual is in malaysia for 182 days or more in a basis year. You reside in malaysia for a period of more than 182 days in an assessment year usually 1st jan to 31st dec you earn at least rm34 000 a year after epf deductions. Circumstances determining residence status section 7 of the act sets down 4 circumstances of which an individual can qualify as a tax resident in malaysia for the basis year for a year of assessment.

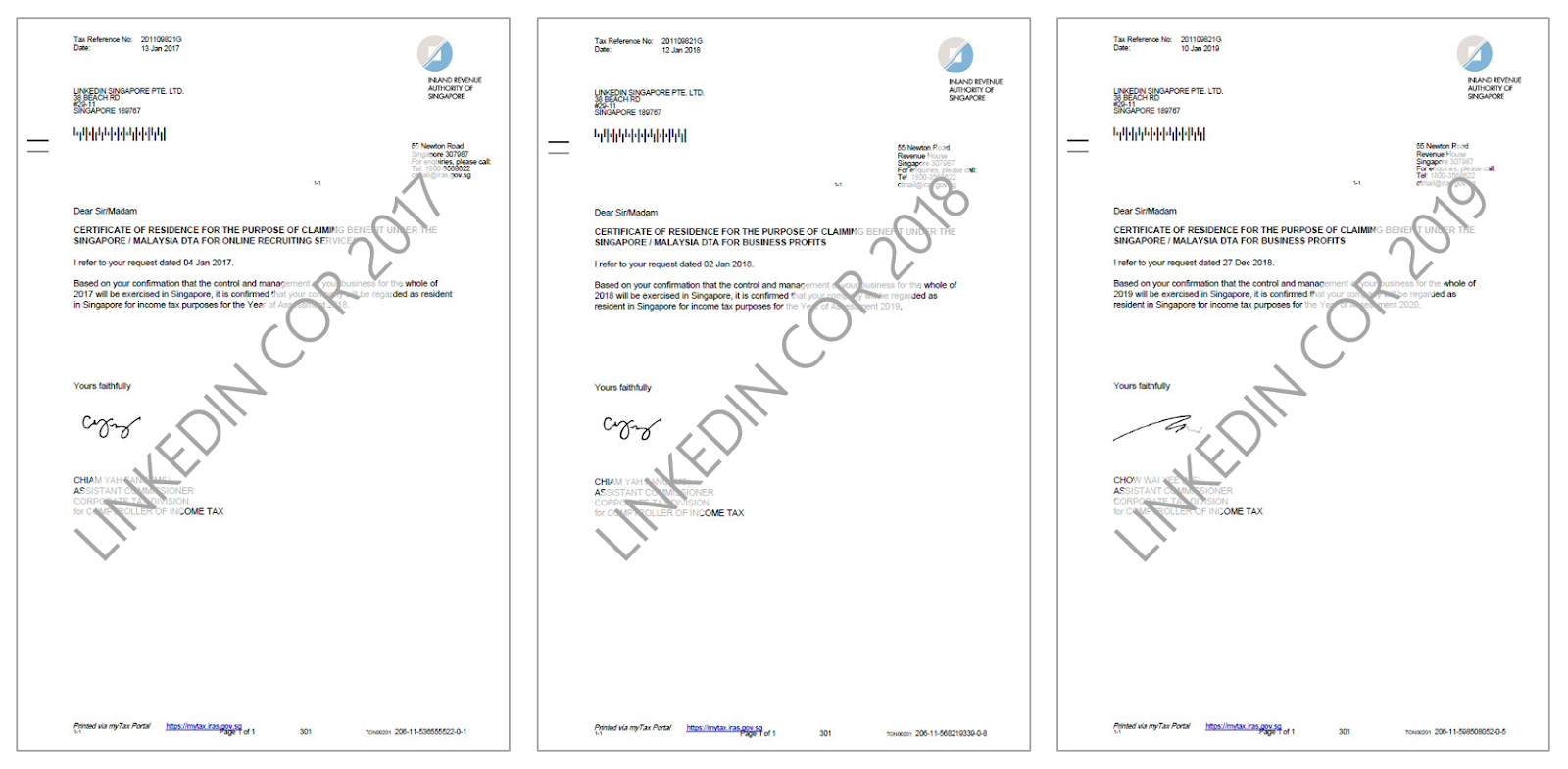

2 the individual is in malaysia for less than 182 days in a basis year. 3e accounting can assist in your cor application. Download the certificate of residence from 2017 to 2019 by google facebook linkedin here plus tips on how to submit withholding tax payment to lhdn. A a certificate of residence cor is an official document issued by irbm to confirm that the taxpayer is resident in malaysia for tax purposes.

The certificate of residence cor is used to verify your tax residence status and can allow you to claim credits under tax treaties with malaysia. Apply certificate of residence application cor services in malaysia.