Company Tax Rate 2017

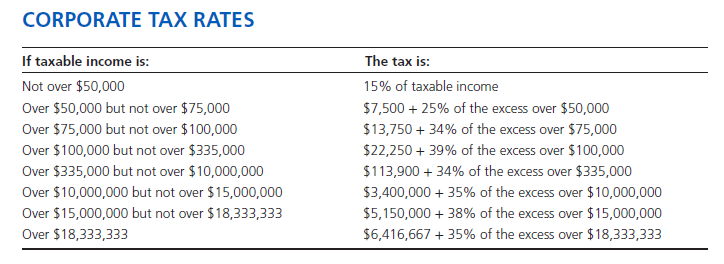

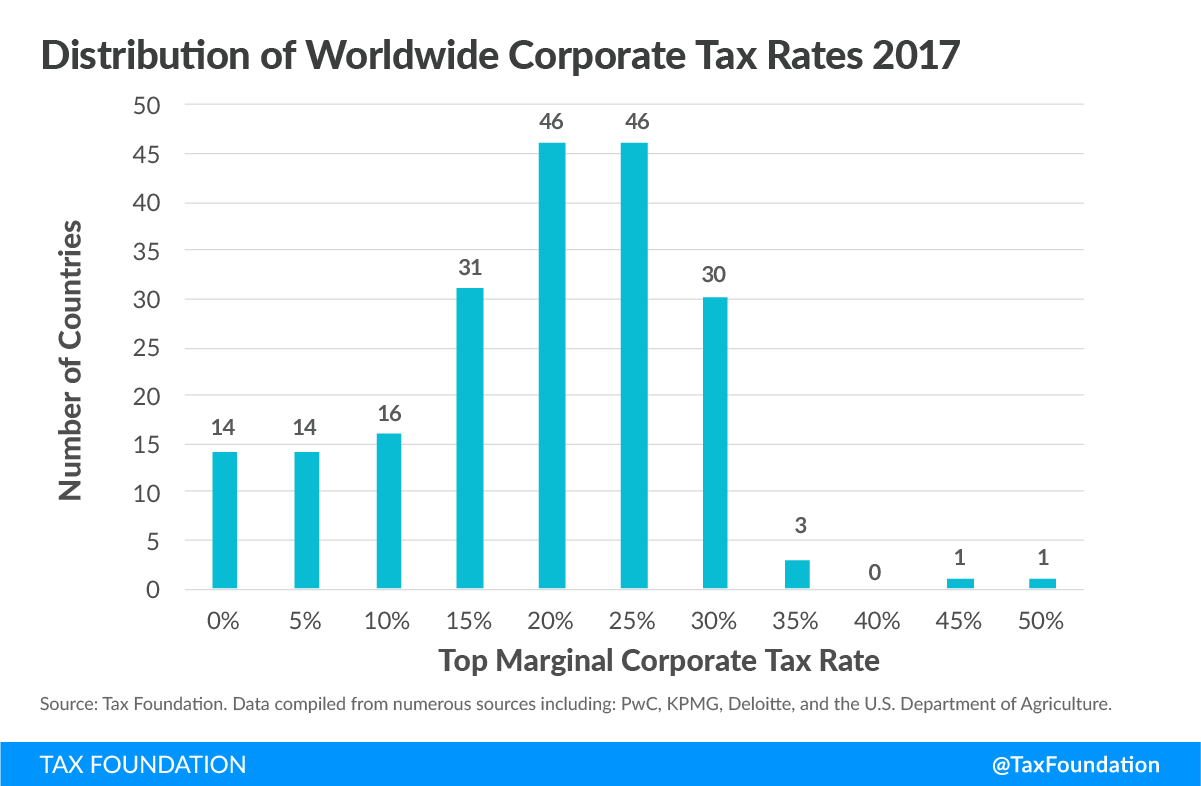

The creation of the federal corporate income tax occurred in 1909 when the uniform rate was 1 for all business income above 5 000.

Company tax rate 2017. Before calling us visit covid 19 tax time essentials or find answers to our top call centre questions. 59 098 28 of taxable income above 550 000. 365 001 550 000. Since then the rate has increased to as high as 52 8 in 1969.

On the first 2 500. Calculations rm rate tax rm 0 5 000. On the first 5 000 next 15 000. In addition to the above tax rates companies are also liable to pay surcharge and cess.

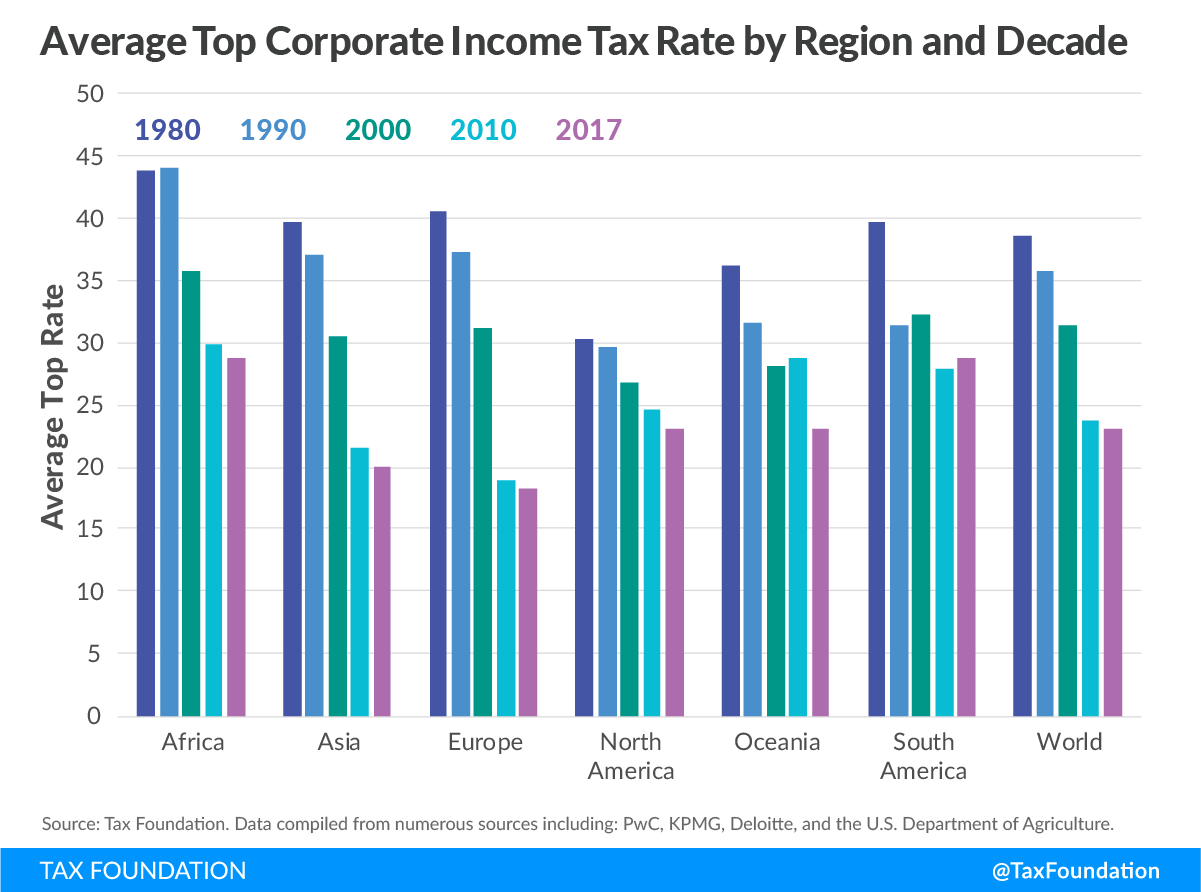

Financial years ending on any date between 1 april 2016 and 31 march 2017. Small business company tax rate for 2016 17 2017 18 2018 19 and 2019 20 is 27 5 the general company income tax rate is 30. The company tax rates in australia from 2001 02 to 2019 20. 115 97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax amt effective for tax years beginning after december 31 2017.

Tax rate 25 or 30 for previous year 2017 18 will be determined based on the turnover of the previous year 2015 16. From the 2017 18 income year companies that are base rate entities must apply the lower 27 5 company tax rate. 550 001 and above. 75 751 365 000.

7 of taxable income above 75 750. 1 2018 the corporate tax rate was changed from a decades long tiered structure which staggered corporate tax rates based on company income. 0 75 750. A base rate entity is a company that both.

20 248 21 of taxable income above 365 000. High call volumes may result in long wait times.

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)